Are you looking for cheap car insurance in Florida? With its gorgeous beaches, world-famous theme parks, and thriving nightlife, it’s no wonder that more than 10 million people call this state home. But the cost of living here is much higher than in most other places in the country. The average cost of a home in Florida is nearly $200,000, which is more than double the national median home price. Even something as essential as car insurance can be costly when you live here. To ensure you can responsibly operate a vehicle within the confines of this state, you need to get car insurance in Florida that meets specific requirements set forth by your local DMV. In order to find an affordable policy that also meets those requirements and exceeds them wherever possible, read on for some great tips and advice about how to get cheap car insurance in Florida.

Benefits of having cheap car insurance in Florida

The benefits of having car insurance in Florida are many. First, it will protect you and your family from the financial consequences of an accident. It also provides you with a means of recovering your vehicle if it’s stolen or should be involved in a collision. Make sure to get the best coverage for your needs—there are many options to choose from, including liability, comprehensive, and collision. We’re here to help you find the right company for you and your needs.

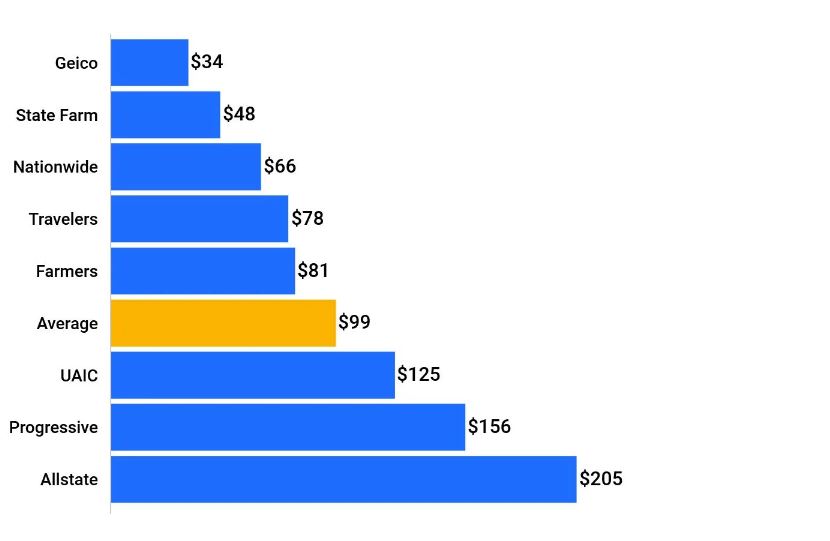

List of cheap car Insurance companies in Florida

- Allstate Corporation

- Progressive Corporation

- UAIC, United Automobile Insurance Company

- Farmers Insurance Group

- Travelers Companies, Inc

- Nationwide Mutual Insurance Company

- State Farm Insurance Company

- GEICO Insurance Company

Estimate How Much Car Insurance You Need

The first step in getting cheap car insurance in Florida is estimating how much coverage you need. Coverage amounts will depend on many factors, including the value of your vehicle and the amount of liability you want to maintain in the event that you cause a serious accident. If you have a car loan, you may be required to maintain full coverage in order to avoid having your loan called in early. If you have equity in your car, it’s a good idea to purchase a policy with the highest coverage amount possible. This will allow you to recoup the cost of replacing your vehicle should you be involved in an accident in which you are at fault. If you’re financing or leasing a vehicle, be sure to check with your lender or leasing company to see what coverage amounts they require you to maintain. Additionally, if you have a low debt-to-income ratio, you may qualify for lower coverage amounts.

Shop Around for the Best Rates

Once you have a general idea of how much coverage you need, it’s time to shop around for the best rates. While you can use online tools like Insurance.com to estimate what different companies will charge you for a specific policy, you can’t be sure that the quotes you receive will be the same as the ones you get from visiting an agent in person. An agent sitting behind a desk might not be able to offer you the same low rates you can find online. If you want to ensure you’re getting the best rates possible, visit an agent in person and explain your situation. Most agents will ask you a few questions about your driving history and vehicle in order to determine if you’re a good candidate for their company.

Check Out Company Reputation

When you’re exploring different car insurance policies, you might notice that some companies have better reputations than others. To determine which insurers are most reputable, check out rankings published by groups like J.D. Power and Consumer Reports. Regardless of whether or not you get your car insurance from a well-known or lesser-known company, you may want to keep your business with them going. If you have a few policies with one insurer and decide to switch to another, you may have to start from scratch. If you’ve had a few accidents or tickets on your record in the past, you might be at a disadvantage when applying for a new policy. In that case, it might be best to stay with your existing company, even if you’re paying more for your coverage.

Get an Auto Insurance Quote Based on your Research

You’ve selected the insurance companies with the best reputations and have gotten some online quotes from trusted insurers. Now, it’s time to pick the one that offers the best coverage at the lowest price. Consider other factors that could affect your auto insurance rates, such as your driving history and the make and model of your vehicle. While driving within Florida’s city limits will require you to maintain basic liability coverage only, you’ll need additional types of coverage if you plan to drive on Florida’s highways. If you plan to travel outside of Florida and want to drive with your out-of-state license, you’ll also need to get additional types of coverage.

Compare Theft Protection and Other Benefits

When you compare auto insurance policies, also compare the different types of coverage they offer and what additional benefits they might provide. Some companies will include insurance coverage for towing and labor costs in their policies, while others will not. While having this coverage is important, you’ll want to be sure that the company you choose doesn’t charge you more for the privilege of having it.

Summing up

Florida is known for its beautiful beaches, vibrant cities, and year-round warm weather. It’s also known for having some of the most expensive car insurance rates in the country. Fortunately, there are ways to get cheap car insurance in Florida by researching your options and shopping around for low rates. Estimate how much coverage you need, shop around for rates, and get an auto insurance quote based on your research. Once you have these steps under control, you should be able to find an affordable car insurance policy that meets your needs.

- Why Every New Investor Needs a Demat Account in 2025 & How to Open One Easily Online

- Top 5 Strategies to Boost Sales with Smart CRM Software for Realtors

- Finding Hope: Best Cancer Specialists in Lucknow for Advanced Care

- ✅ Who is the Best Stomach Specialist Doctor in Lucknow?

- Why Ordering Rakhi Online is the New Trend in India

Thanks for visiting our website to get the knowledgeable information for your query. ReadWriteTips is always try to share most relevant information to our visitors.